Bybit is a popular cryptocurrency exchange platform that offers both spot and derivatives trading, catering to different types of traders with varying goals. Spot trading involves the immediate settlement of cryptocurrencies, where you directly own the asset and can hold it long-term or use it for payments.

In contrast, derivatives trading involves contracts that derive their value from an underlying asset, often involving leverage, which can amplify both profits and losses.

Understanding the key differences between spot and derivatives trading on Bybit can help you make informed decisions that align with your trading objectives.

What is Spot Trading?

- Spot trading involves buying and selling cryptocurrencies for immediate settlement.

- The transaction is settled “on the spot,” meaning you own the cryptocurrency instantly after the trade is executed.

- Ownership: You directly own the asset you purchase, whether it’s Bitcoin, Ethereum, or any other cryptocurrency.

- Usage: Ideal for traders who want to hold assets for the long term or use them for other purposes like payments or transfers.

- Price: Spot prices reflect the current market price of the cryptocurrency.

- Simplicity: Spot trading is straightforward, making it suitable for beginners.

- Risk: Limited to the price movement of the asset you hold. You can only lose the amount you invested.

- Example: If you buy 1 BTC at $30,000 on a spot market, you now own 1 BTC, and your profit or loss depends on BTC’s price movement.

What is Derivatives Trading?

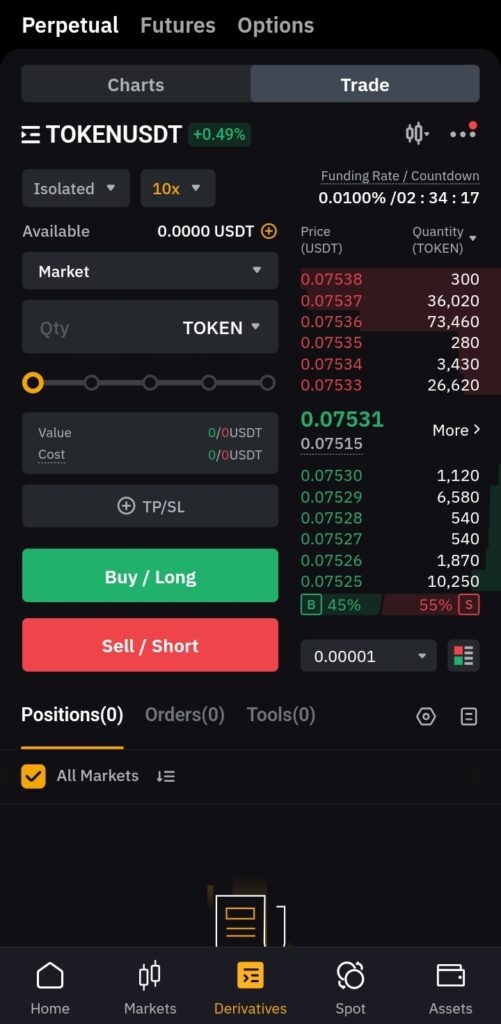

- Derivatives trading involves trading contracts that derive their value from the price of an underlying asset, like Bitcoin or Ethereum.

- No Direct Ownership: In derivatives trading, you don’t own the underlying asset. Instead, you own a contract that represents the asset.

- Leverage: Derivatives trading often involves leverage, allowing you to control a larger position with a smaller amount of capital.

- Types of Derivatives: Includes futures, options, and perpetual contracts.

- Complexity: More complex compared to spot trading. It requires understanding leverage, margin, and contract specifications.

- Risk: Higher than spot trading due to leverage, which can amplify both gains and losses. You can lose more than your initial investment.

- Example: If you enter a 10x leveraged long position on Bitcoin at $30,000, and it increases to $31,000, your profit would be amplified. Conversely, if it drops to $29,000, your losses would also be amplified.

Key Differences Between Bybit Spot and Derivatives Trading

1. Ownership of Assets

- Spot Trading: You directly own the cryptocurrency you purchase.

- Derivatives Trading: You don’t own the underlying cryptocurrency. Instead, you own a contract that reflects the asset’s price.

2. Leverage

- Spot Trading: Typically involves no leverage. You buy or sell assets with the capital you have.

- Derivatives Trading: Commonly involves leverage, allowing you to trade larger positions with less capital.

3. Risk Level

- Spot Trading: Generally lower risk because you can only lose what you have invested.

- Derivatives Trading: Higher risk due to leverage. Potential for amplified gains but also amplified losses.

4. Complexity

- Spot Trading: Simpler and more suitable for beginners.

- Derivatives Trading: More complex, requiring a better understanding of market dynamics, leverage, and risk management.

5. Trading Objectives

- Spot Trading: Suited for long-term investors looking to hold assets and benefit from price appreciation over time.

- Derivatives Trading: Suited for traders aiming for short-term profits, especially those comfortable with higher risks and looking to capitalize on market volatility.

6. Market Exposure

- Spot Trading: Exposure is limited to the cryptocurrency you own.

- Derivatives Trading: Offers exposure to a broader range of strategies, including hedging, speculation, and arbitrage.

7. Settlement

- Spot Trading: Immediate settlement. You own the asset right after the trade.

- Derivatives Trading: Settlement depends on the contract terms. For example, futures contracts have an expiration date, while perpetual contracts do not.

8. Profit Potential

- Spot Trading: Profit depends solely on the price movement of the asset you hold.

- Derivatives Trading: Profit potential is higher due to leverage but also carries the risk of greater losses.

9. Fees

- Spot Trading: Typically, lower fees. You may pay a small fee for each transaction.

- Derivatives Trading: Fees can be higher, especially when trading with leverage. Includes funding rates, which are ongoing fees for holding leveraged positions.

10. Market Participation

- Spot Trading: Ideal for buy-and-hold strategies, where traders purchase assets and hold them over time.

- Derivatives Trading: Attracts active traders who engage in frequent buying and selling, often within short time frames.

Bybit Spot Trading: Pros and Cons

Pros:

- Ownership: You own the actual cryptocurrency.

- Lower Risk: You can only lose the amount you invested.

- Simplicity: Easier to understand, making it beginner-friendly.

- No Expiration: You can hold your assets indefinitely.

- Less Stress: No need to worry about liquidation or margin calls.

Cons:

- No Leverage: Limited to the capital you have.

- Lower Profit Potential: Gains are proportional to the amount invested.

- Market Risk: Your assets are exposed to market fluctuations.

- Long-Term Focus: May not be suitable for those looking for quick profits.

Bybit Derivatives Trading: Pros and Cons

Pros:

- Leverage: Amplifies profit potential with smaller capital.

- Flexibility: Offers various strategies like short selling, hedging, and arbitrage.

- Volatility Profits: Potential to profit in both rising and falling markets.

- Hedging: Ability to hedge existing positions, reducing risk in other investments.

Cons:

- Higher Risk: Possibility of losing more than the initial investment.

- Complexity: Requires a good understanding of leverage, margin, and contract specifications.

- Ongoing Costs: Funding rates and other fees can add up, especially in long-term positions.

- Stressful: Constant monitoring required, especially in volatile markets.

Which Should You Choose?

1. Experience Level

- Beginner: Spot trading is recommended due to its simplicity and lower risk.

- Experienced Trader: Derivatives trading offers more tools and strategies but requires a solid understanding of markets and risk management.

2. Investment Horizon

- Long-Term: Spot trading is better for those who want to hold assets and benefit from long-term appreciation.

- Short-Term: Derivatives trading suits those looking for short-term profits and who are comfortable with higher risks.

3. Risk Appetite

- Low Risk Tolerance: Spot trading is ideal for risk-averse traders.

- High Risk Tolerance: Derivatives trading offers higher potential returns but comes with increased risk.

4. Capital Availability

- Limited Capital: Derivatives trading can be appealing due to leverage but requires careful risk management.

- Sufficient Capital: Spot trading allows you to own assets outright, avoiding the risks associated with leverage.

5. Market Conditions

- Bull Market: Spot trading benefits from price appreciation over time.

- Bear Market: Derivatives trading, especially short-selling, allows profiting from declining prices.

Related:

- Bybit vs MEXC

- Bybit vs. OKX

- Bybit vs Kucoin

- Bybit vs Binance

- Bybit Review

- Bybit vs Bitget

- Bybit Vs BingX

Conclusion

Bybit Spot vs. Derivatives: The choice between spot and derivatives trading on Bybit ultimately depends on your trading goals, risk tolerance, and experience level. Spot trading offers simplicity, direct ownership, and lower risk, making it suitable for beginners and long-term investors.

On the other hand, derivatives trading provides leverage, flexibility, and the potential for higher profits, but it requires a strong understanding of the market and a higher risk tolerance.

Your strategy should consider your financial goals, trading experience, and how much time you can dedicate to monitoring the markets when choosing between spot and derivatives trading.

Whether you’re drawn to the simplicity of spot trading or the excitement of derivatives, it’s crucial to trade responsibly and understand the risks involved.

Calculate Your Crypto Tax: