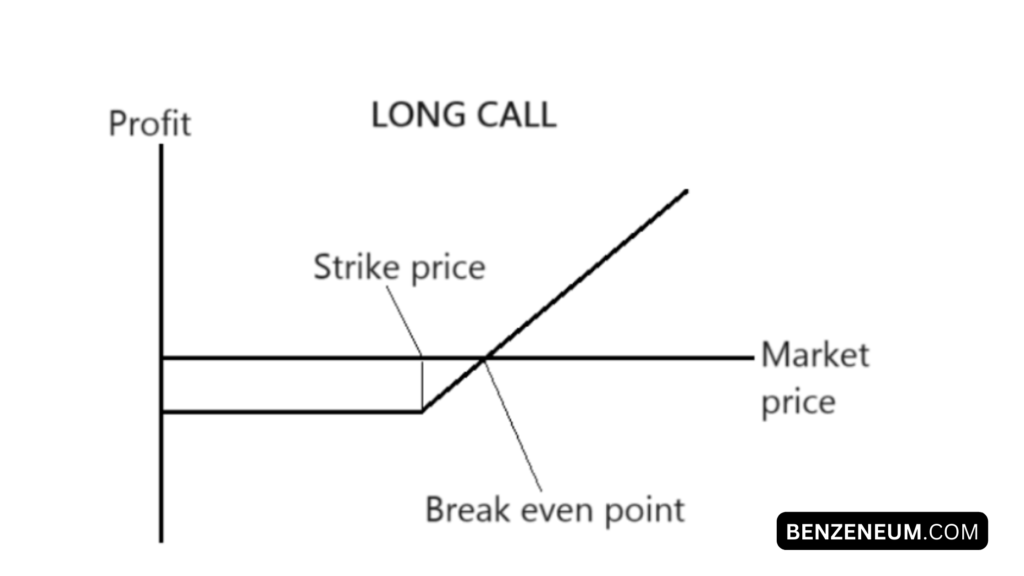

Options trading is a fascinating and complex field within the broader spectrum of financial markets. At its core, options trading involves contracts known as options, which give the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price before a specified expiration date. The two primary types of options are calls and puts. A call option provides the right to buy, while a put option grants the right to sell the underlying asset.

Understanding how these instruments work is crucial for anyone looking to engage in options trading. In essence, buying a call option is a bullish strategy, anticipating that the price of the underlying asset will rise. Conversely, purchasing a put option is a bearish strategy, betting on the price dropping. The flexibility and leverage offered by options can make them an attractive addition to an investment portfolio, but they also come with significant risks.

My journey into options trading began out of a desire to diversify my investment strategies. Initially, I was intrigued by the potential for high returns, but I quickly learned that a deep understanding of the market and the instruments is essential. One must be aware of the complexities and nuances involved in options trading to minimize risks and maximize potential gains.

For instance, the concepts of ‘buy to open’ and ‘buy to close’ are fundamental to executing trades effectively. These terms refer to the different stages of the options trading process, with ‘buy to open’ initiating a new position and ‘buy to close’ closing an existing one.

Before diving into options trading, it’s important to educate oneself thoroughly. Understanding the basic types of options and how they function can set a solid foundation. As we dive deeper into the specifics of ‘buy to open’ and ‘buy to close’, this foundational knowledge will prove invaluable.

What Does ‘Buy to Open’ Mean?

‘Buy to Open’ is a fundamental concept in options trading, signifying the act of initiating a new position in the market. When you ‘buy to open,’ you are either purchasing a call option or a put option, thus opening a new contract. This action is pivotal for traders looking to capitalize on market movements, whether they anticipate an upward or downward trend.

For instance, if you believe a stock’s price will rise, you might choose to ‘buy to open’ a call option. Conversely, if you predict a decline, buying a put option would be your go-to strategy. This approach allows traders to leverage their market outlooks effectively.

In my own trading experiences, ‘buy to open’ has been instrumental in capturing opportunities arising from market volatility. I recall a specific scenario where I anticipated a significant price increase in a tech stock due to an upcoming product launch.

By buying to open a call option, I secured the right to purchase the stock at a pre-determined price, thereby maximizing my potential gains as the stock price surged.

Strategically, ‘buy to open’ serves multiple purposes. It can be used as a hedge against existing positions, providing a safety net in unpredictable market conditions. Additionally, it allows for speculation, giving traders the flexibility to profit from short-term market movements without the need for large capital investment.

Understanding when and how to ‘buy to open’ can significantly enhance your trading strategy. It provides an avenue to manage risk, capitalize on market predictions, and diversify trading activities. By integrating ‘buy to open’ into your trading repertoire, you can navigate the options market with greater confidence and precision, ensuring your actions align with your broader investment goals.

Understanding ‘Buy to Close’

‘Buy to close’ is a fundamental concept in options trading that denotes the action of purchasing an option to exit or close an existing short position. In options trading, a short position arises when a trader sells an option contract, anticipating a decrease in its value. However, to close this short position, the trader needs to ‘buy to close’ the contract, effectively nullifying the open position.

This mechanism is essential for traders who initially sold options contracts, either as a speculative strategy or as a part of a more complex trading plan.

For instance, if you sold a call option expecting the underlying asset’s price to drop, but the market moves in the opposite direction, you might decide to ‘buy to close’ the position to mitigate potential losses. Conversely, if the market aligns with your expectations and the option’s value declines, you can ‘buy to close’ at a lower price, realizing a profit.

One real-life example involves an investor who sells a put option on a stock they believe will not fall below a certain price. If the stock’s price remains stable or rises, the put option’s value will decrease. The investor may then ‘buy to close’ the put option at a reduced price, thereby securing a profit.

Contrasting ‘buy to close’ with ‘buy to open’ helps clarify these terms. While ‘buy to open’ is used to initiate a new long position in an options contract, ‘buy to close’ is employed to terminate a short position.

It is crucial to distinguish between the two, as they serve different purposes in an investor’s trading strategy.

When considering when to use ‘buy to close,’ it is important to monitor market conditions and the performance of the underlying asset. Timely execution of a ‘buy to close’ order can be a strategic move to lock in profits or minimize losses. Additionally, staying informed about market trends and employing risk management techniques can enhance the effectiveness of this trading practice.

Understanding the nuances of ‘buy to close’ and employing it judiciously can significantly impact your options trading success. By mastering this concept, traders can better navigate the complexities of the options market and make informed decisions.

Comparing ‘Buy to Open’ and ‘Buy to Close’

In the realm of options trading, understanding the nuances between ‘buy to open’ and ‘buy to close’ is crucial for developing a robust trading strategy. While both terminologies might seem similar to beginners, they serve distinctly different purposes that can significantly impact trading outcomes.

‘Buy to open’ refers to the initiation of a new position in the options market. When you ‘buy to open,’ you are purchasing an option contract, either a call or a put, intending to benefit from a future price movement.

This action is the starting point of your investment, where you establish a foothold in the market. For instance, if you anticipate a stock’s price will rise, you might ‘buy to open’ a call option, aiming to profit from the upward movement.

In contrast, ‘buy to close’ is an action taken to close an existing short options position. When you ‘buy to close,’ you are purchasing an option to cancel out a previously sold option position. This is a strategic move to lock in profits or mitigate potential losses. For example, if you initially sold a call option expecting the stock price to remain stable or decline, but now the market shows upward momentum, you might ‘buy to close’ that call option to avoid further losses.

The primary difference lies in the intent: ‘buy to open’ is about starting a new option position, while ‘buy to close’ is about terminating an existing one.

Both actions play pivotal roles in a comprehensive trading strategy, providing flexibility to adapt to market conditions.

To effectively implement these strategies, it’s essential to stay informed about market trends and continuously review your positions.

Regularly assessing your risk tolerance and investment goals will help you decide when to ‘buy to open’ or ‘buy to close.’ Utilizing tools such as stop-loss orders can also provide an additional layer of risk management, ensuring that your investments are protected against unexpected market shifts.

By mastering the concepts of ‘buy to open’ and ‘buy to close,’ you can enhance your decision-making process, ultimately leading to more confident and informed trading actions.

Is it better to buy stock at open or close?

There is no definitive answer, as it depends on your strategy and market conditions. Buying at open can take advantage of overnight news and momentum, but it’s also more volatile. Buying at close can give you a clearer picture of the day’s trend and reduce exposure to overnight risk.

Do I sell to open or sell to close?

- Sell to Open: This is used when you are writing (selling) an option contract. It’s a bearish strategy, implying you expect the underlying stock to decline.

- Sell to Close: This is used to close an existing long position in an option. It can be part of a bullish or bearish strategy, depending on your original position.

What is the 3-5-7 rule in trading?

The 3-5-7 rule is a guideline for setting stop-loss orders:

- 3% stop-loss for short-term trades.

- 5% stop-loss for medium-term trades.

- 7% stop-loss for long-term trades.

This helps traders limit potential losses based on the time frame of their investment.

What is the 10 am rule in trading?

The 10 am rule suggests waiting until after 10 am to make trades. The market is often highly volatile during the first half-hour of trading (9:30 am – 10:00 am). Waiting until 10 am allows the initial volatility to settle, providing a clearer trend and reducing the risk of making impulsive decisions.

Is sell to open bullish or bearish?

Sell to open is generally a bearish strategy. When you sell to open, you’re writing an options contract, often a call, expecting the stock to either stay flat or decline in price.

What is the 90% rule in trading?

The 90% rule suggests that 90% of a stock’s movement happens in 10% of the time. This means that most of the time, a stock will trade within a range, and significant price movements are rare and concentrated in short periods. This rule underscores the importance of timing and being prepared for those rapid moves.

When to buy: uptrend or downtrend?

Generally, it’s better to buy during an uptrend. Buying in an uptrend aligns your position with the prevailing market direction, increasing the likelihood of gains. Buying in a downtrend can be risky, as it goes against the market’s momentum, but it can be profitable if timed correctly as a reversal trade or for short selling.

These guidelines are meant to provide a foundation, but individual trading strategies and market conditions can vary widely. Always consider your risk tolerance and conduct thorough research before making trading decisions.