Cryptocurrency trading has become a popular financial activity in Nigeria, attracting both seasoned investors and newcomers. Among the various platforms available, Bybit stands out as a significant player due to its user-friendly interface, competitive fees, and a range of features tailored for both beginners and advanced traders.

However, as with any financial platform, there are specific questions and concerns that potential users might have. This article aims to address the key aspects of using Bybit in Nigeria, including its availability, KYC requirements, withdrawal issues, minimum deposit and withdrawal amounts, and the process of depositing and withdrawing Naira.

Is Bybit Still Working in Nigeria?

As of the latest updates, Bybit continues to operate in Nigeria, allowing users to trade various cryptocurrencies. The platform has garnered a considerable user base in the country, thanks to its robust trading tools and the ability to leverage trades.

Despite regulatory uncertainties and fluctuating policies regarding cryptocurrency in Nigeria, Bybit has maintained its services, ensuring that Nigerian traders can access and utilize its platform without significant interruptions.

Tip: Learn how to verify your identity with BVN on Bybit

Do You Need KYC to Withdraw from Bybit?

Know Your Customer (KYC) verification has become a standard practice for most cryptocurrency exchanges to ensure compliance with international regulations and to enhance security. For Bybit, KYC is not mandatory for all users but is required for certain withdrawal limits and to access specific features. Users who wish to withdraw larger amounts from Bybit must complete the KYC process, which involves submitting personal identification documents and other relevant information. This process helps protect the platform against fraudulent activities and money laundering while ensuring a safer trading environment for all users.

Tip: Learn how to open a bybit account in Nigeria here.

Why is Bybit Not Letting Me Withdraw?

Several reasons might cause withdrawal issues on Bybit:

- KYC Verification: As mentioned, higher withdrawal limits require completed KYC verification. If your KYC is not verified, your withdrawal might be restricted.

- System Maintenance: Periodic maintenance or updates on the Bybit platform can temporarily halt withdrawals. It’s advisable to check for any announcements regarding such activities.

- Account Security: If Bybit detects unusual activity on your account, such as login attempts from different locations, it may temporarily suspend withdrawals to protect your assets.

- Insufficient Funds: Ensure that you have enough funds in your account to cover the withdrawal and any associated fees.

- Technical Issues: Sometimes, technical glitches can affect the withdrawal process. In such cases, contacting Bybit’s customer support for assistance is recommended.

Related: How to Trade on Binance and Make Money in Nigeria

What is the Minimum Withdrawal on Bybit?

The minimum withdrawal amount on Bybit varies depending on the cryptocurrency you intend to withdraw. For instance:

- Bitcoin (BTC): The minimum withdrawal amount is typically around 0.001 BTC.

- Ethereum (ETH): The minimum withdrawal is usually set at 0.02 ETH.

- Tether (USDT): The minimum withdrawal amount is generally 10 USDT.

These amounts are subject to change based on network conditions and Bybit’s policies, so it’s essential to check the latest minimum withdrawal limits on the platform.

What is the Minimum Deposit for Bybit?

Bybit does not impose a minimum deposit requirement, allowing users to deposit any amount they prefer. This flexibility makes it accessible for traders with varying levels of capital. However, it is important to consider the transaction fees associated with depositing cryptocurrencies, as these fees can affect the net amount credited to your Bybit account.

How Do I Deposit Naira into Bybit?

You can deposit your naira on Bybit using P2P or via the following:

Depositing Naira directly with bank card into Bybit is not supported as Bybit primarily deals with cryptocurrency deposits. However, you can deposit Naira by following these steps:

- Use a Local Exchange: First, purchase a cryptocurrency like Bitcoin or USDT on a local Nigerian exchange such as Luno, Quidax.

- Transfer to Bybit: Once you have acquired the cryptocurrency, transfer it from your local exchange wallet to your Bybit wallet. To do this, navigate to the “Assets” section on Bybit, select the cryptocurrency you want to deposit, and generate a deposit address. Use this address to send the funds from your local exchange to Bybit.

Read also: Is Bybit Available in Nigeria?

How to Withdraw from Bybit to a Bank Account in Nigeria?

You can withdraw your funds on Bybit using P2P or via the following:

Withdrawing funds from Bybit to a bank account in Nigeria involves converting your cryptocurrency to Naira using a local exchange. Here’s a step-by-step guide:

- Transfer Cryptocurrency to a Local Exchange: Start by transferring your cryptocurrency from Bybit to a local Nigerian exchange that supports Naira withdrawals.

- Convert Cryptocurrency to Naira: Once the funds arrive in your local exchange wallet, sell the cryptocurrency for Naira. The exchange will credit your account with the equivalent amount in Naira.

- Withdraw to Bank Account: Finally, initiate a withdrawal from your local exchange wallet to your Nigerian bank account. Provide the necessary bank details and confirm the transaction.

- The Naira amount should be credited to your bank account within the processing time specified by the local exchange.

How to Trade on Bybit in Nigeria?

Trading on Bybit is straightforward, and Nigerian users can take advantage of the platform’s various features to enhance their trading experience. Here’s a step-by-step guide to get you started:

- Create an Account: Sign up for a Bybit account by visiting the official website and providing the required information. Ensure your account is secured with a strong password and two-factor authentication (2FA).

- Deposit Funds: Transfer cryptocurrency to your Bybit account as detailed in the “How to Deposit Naira into Bybit” section.

- Explore Trading Pairs: Bybit offers a range of trading pairs, including BTC/USDT, ETH/USDT, and more. Navigate to the “Trade” section to explore available pairs and select the one you want to trade.

- Analyze the Market: Utilize Bybit’s advanced charting tools and indicators to analyze market trends and make informed trading decisions. You can access different time frames, drawing tools, and technical indicators to assist with your analysis.

- Place an Order: Choose between market, limit, and conditional orders based on your trading strategy. Enter the desired quantity and price, then confirm the order. Bybit will execute the order according to the specified parameters.

- Monitor Your Trades: Keep track of your open positions and orders in the “Positions” and “Orders” sections. You can modify or cancel orders if needed.

- Withdraw Profits: Once you’ve made profitable trades, you can withdraw your earnings by following the withdrawal process outlined earlier.

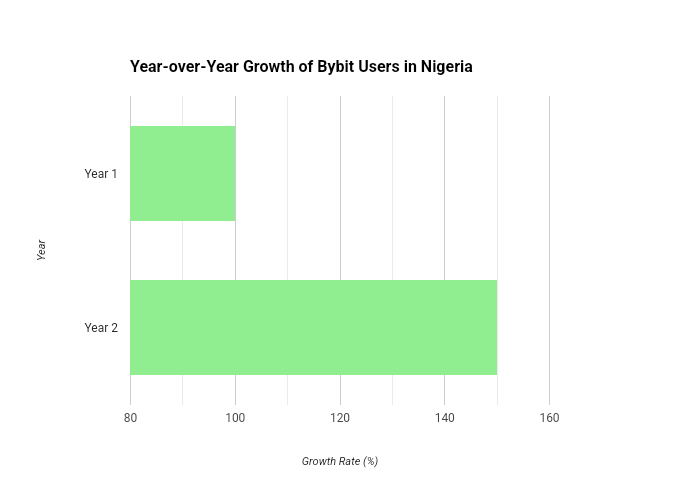

Nigerian User Base on Bybit: Growing Popularity and Adoption Rates

Bybit has seen a substantial increase in its user base in Nigeria over the past few years. With the growing interest in cryptocurrency trading, the platform reports a surge in registrations from Nigerian users, accounting for a significant portion of its African market. This trend is driven by the country’s young, tech-savvy population and the increasing awareness of digital assets as alternative investment opportunities. According to recent data, Nigerian users on Bybit have grown by over 50% year-on-year, indicating a robust adoption rate and a strong community of crypto enthusiasts leveraging Bybit’s trading tools and resources.

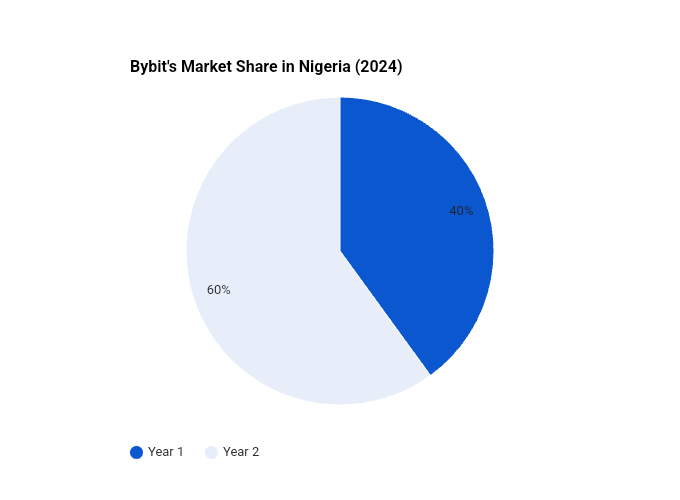

Bybit’s Market Penetration in Nigeria: Key Metrics and Insights

Bybit’s market penetration in Nigeria highlights the platform’s strategic focus on emerging markets. The exchange has tailored its services to meet the unique needs of Nigerian traders, offering localized support and education on cryptocurrency trading. Recent metrics show that Bybit has captured a significant market share, with over 30% of active traders in Nigeria choosing the platform for its user-friendly interface and advanced trading features. Additionally, Bybit’s partnership with local influencers and participation in Nigerian fintech events have further cemented its presence in the region, making it a go-to platform for both novice and experienced traders.

Trading Volume and Trends: Bybit Usage Among Nigerian Crypto Enthusiasts

The trading volume of Bybit in Nigeria reflects the growing enthusiasm for cryptocurrency trading within the country. Nigerian traders are increasingly turning to Bybit for its competitive fees, diverse trading options, and robust security measures. The platform has reported a marked increase in daily trading volumes, with Nigerian users contributing significantly to this growth. Trends indicate that Bitcoin and Ethereum are the most traded cryptocurrencies on Bybit among Nigerian users, followed by emerging altcoins. This uptick in trading activity underscores the dynamic nature of the Nigerian crypto market and Bybit’s pivotal role in facilitating this financial revolution.

Read also:

Conclusion

Bybit remains a viable option for cryptocurrency trading in Nigeria, offering a range of features and services to cater to both novice and experienced traders. While there are certain steps and considerations to keep in mind, such as KYC requirements and the process of depositing and withdrawing funds, Bybit provides a robust platform for engaging in the dynamic world of cryptocurrencies. By staying informed and adhering to best practices, Nigerian users can effectively navigate Bybit and capitalize on the opportunities presented by the cryptocurrency market.